EXPLORE THE DIFFERENCES BETWEEN ATM AND DEBIT CARDS

Both ATM and debit cards are safe, convenient ways to get cash, make deposits, transfer funds, and make purchases. They look almost the same, but each have a different purpose and do different things. This resource will help you learn the differences between ATM cards and debit cards.

ATM Cards

The purpose of an ATM card is to get cash from your account. An ATM card is a PIN-based card and can be linked to a checking or savings account. The money taken out will lower your account balance right away, so be sure to know how much money you have in your account.

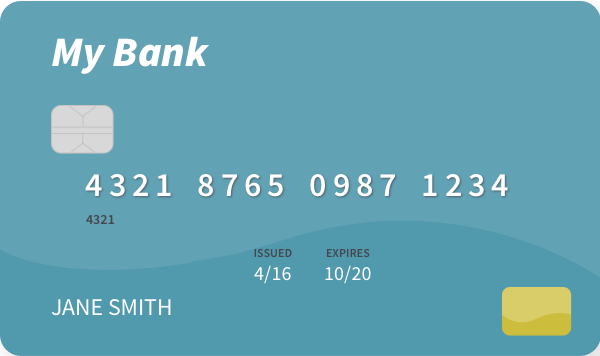

An ATM card has:

- Bank’s name/logo

- Your name

- ATM card number

- Might include a signature bar

- Might include a card verification number (CVV)

- Card expiration date

- Customer service phone number

- Note: ATM cards do not have a Visa® or Mastercard® logo on them

Debit Cards

A debit card looks similar to an ATM card and you can use it at ATMs. When you make a purchase, the funds come out of your checking account. Also, debit cards typically have a Visa®, Mastercard®, American Express®, or Discover® logo on their front. That means you can use a debit card wherever Visa®, Mastercard®, American Express®, or Discover® debit cards are accepted, for example, department stores, restaurants, or online.