what is investing?

saving vs investing

Some people wonder if saving is better than investing, since there is no risk to putting your money in a savings account. We have many resources that go through reasons to invest. For now, here’s a chart to compare some differences between saving and investing.

SAVING

Ready cash

Gives you ready cash; provides funds for emergencies; often used for specific purchases in the near future (usually three years or less).

Minimal risk

Minimal or no risk (if money is in a savings account).

Earn interest

You earn interest, but savings accounts generally earn a lower return than do investments.

INVESTING

Achieve major goals

Can help you achieve long-term, major financial goals.

Always involves risk

You may lose some or all of the money you invest.

Potential for profit

Investments have the potential for higher return than a regular savings account. Your investments may appreciate (go up in value) over time.

types of investments

Before you invest, it’s important to understand the basics about different types of investments. Click a type to learn more.

COMPOUNDING MONEY GROWS

It is important to understand the power of compounding, why it pays to start investing early, and how to use an earnings calculator.

The length of time you invest is a key factor in meeting your financial goals. The earlier you start, the easier it will be to achieve them. Many investors lose out because they wait too long to get started or invest too little. If you don’t start early, it can be difficult to catch up. It pays to start investing as soon as you can, and to take advantage of the power of compounding.

Compounding occurs when your earnings on an investment are added to the amount you originally invested. As your total investment grows larger, your earnings have the potential to grow larger, too. (The same principle applies when you earn compound interest in a savings account.) How fast an investment grows over time depends on the rate of return you earn each year.

Use this calculator to estimate the future value of an investment based on different rates of return. Fill in the sections of the calculator, then click Calculate. If you want to try another example, click ‘Reset’ and start again.

Note: The sooner you start investing, the more time your money has to grow and the harder your money works for you. Get started investing as early as you can!

INFLATION ERODES PURCHASING POWER

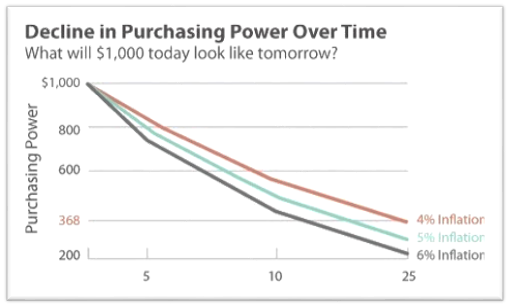

You’ve probably noticed that the prices for lots of things have gone up over the years. When the general price level of goods and services goes up, that means the purchasing power of your dollar goes down. It’s called inflation, and it can really eat away at your future purchasing power. It’s important to understand that if your money isn’t growing at a rate at least equal to the rate of inflation, you’re losing money

Here’s an example: Let’s say you stash $1,000 in a safety deposit box and leave it there for 25 years. Assuming an inflation rate of 4%, when you take the money out, your original $1,000 would only be able to purchase $368 worth of goods! So, try to make sure that your money is always growing at a higher rate than the rate of inflation. This graph shows how inflation affects your money over time.

Saving and investing money can help you counteract the effects of inflation.

the rule of 72

Now that you see why it’s important to do more than just save your money, here’s a helpful way to estimate the amount of time or the interest rate you would need to double your money on savings or an investment. It’s called the Rule of 72.

The rule of 72 in action

Let’s say you have an investment that’s earning 8% per year. Start with the number 72 and divide it by the interest rate, eight. 72 divided by 8 equals 9. This means it would take about nine years for your original investment to double.

You try!

You can use the calculator on this screen to try it for yourself. Type in an interest rate and you’ll see how many years it will take your original savings or investment amount to double. Or if you want, type in the number of years, and you’ll see how high the interest rate would need to be.

Now that you have seen what inflation can do to your spending power, hopefully the Rule of 72 inspires you to earn as much interest on your own savings as you possibly can.