OVERVIEW

Money management is one of the most important parts of your financial life. Knowing how to how to budget, spend and save can help you reach your financial goals, get out of debt, and build your savings. In this resource, you will learn how to manage your money and find tips to help you get to where you want to be financially.

HOW TO MANAGE MONEY

The main areas to manage your money are budgeting, managing spending, saving, and getting out of debt.

money management tips

Getting comfortable with these four tips may help you meet your monthly bills, have a good handle on where your money goes each month, and build a solid plan for meeting future financial goals.

FOUR SIMPLE TIPS

KNOW WHEN YOUR INCOME IS COMING IN

Understand when your paycheck or benefits come in. Some incomes may come in at the same time, while others may not come in on a regular schedule.

KNOW WHAT BILLS YOU NEED TO PAY

Create a list of your bills and when they are due. Plan to have enough money to pay the bills each week or month. Some companies will allow you to change the due date to help you manage your budget.

KNOW WHAT YOU ARE SPENDING

It is important to know what you are spending your money on. Make a list of needs vs wants and focus only on the things you actually need. For more details on spending, go to the All About Spending resource.

KNOW YOUR SAVING STRATEGY

Creating a saving strategy is important so your expenses do not exceed your income. Build a savings strategy that builds emergency savings, which is typically 3 to 6 months of your expenses. A savings strategy can also help you save for future goals like buying a car, taking a trip or paying off debt.

Getting comfortable with these four tips may help you meet your monthly bills, have a good handle on where your money goes each month, and build a solid plan for meeting future financial goals.

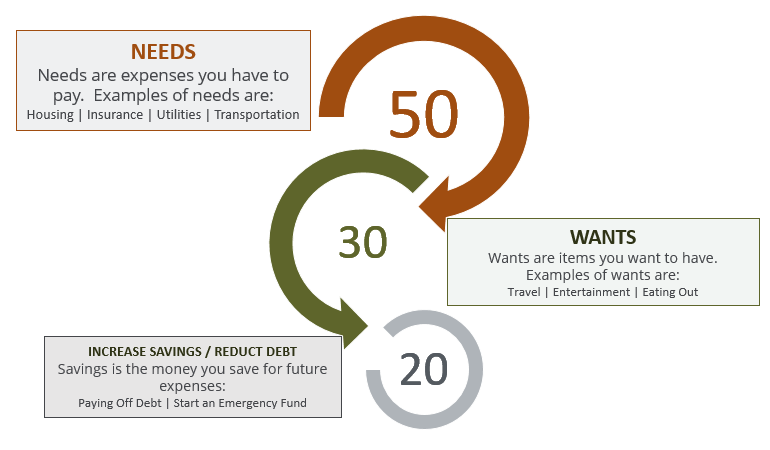

50/30/20

The 50/30/20 rule is a simple budget tool that can help you figure out how much money to save and spend. The infograph below breaks down the details of the 50/30/20 rule.

sPENDING tips

Make the most of the money you have by paying attention to how the little things add up. Before spending, ask yourself:

More tips:

There are other important tips, like being creative to save money and avoiding high cost loans and fees that you also want to keep in mind.