what is a credit report?

Your credit report is a document issued by an independent credit reporting agency that contains information concerning your credit history and current credit standing.

how to Get your credit report

The three largest credit bureaus in the United States are Equifax, Experian, and TransUnion. A federal law called the Fair Credit Reporting Act allows you to receive one free copy of your credit report from each of these three companies once a year.

Tip: Order one report every 90-120 days as a way to regularly monitor your credit throughout the year. As an example, you can order your report from Equifax in January, from Experian in April, and TransUnion in August.

You can get your free credit in three ways:

- Online:

www.annualcreditreport.com - Toll-free call:

(877) 322-8228 - Request by mail:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

If you need more than one credit report in a year from one or more of these credit bureaus, you may be charged. To request additional credit reports, contact one of the following agencies.

To request additional credit reports:

- Equifax Information Services www.equifax.com

- Experian Consumer Assistance www.experian.com

- TransUnion www.transunion.com

Be wary of the many Web sites that advertise free credit reports! Many consumers get tricked into paying for reports and services they don’t really need.

how to read your credit report

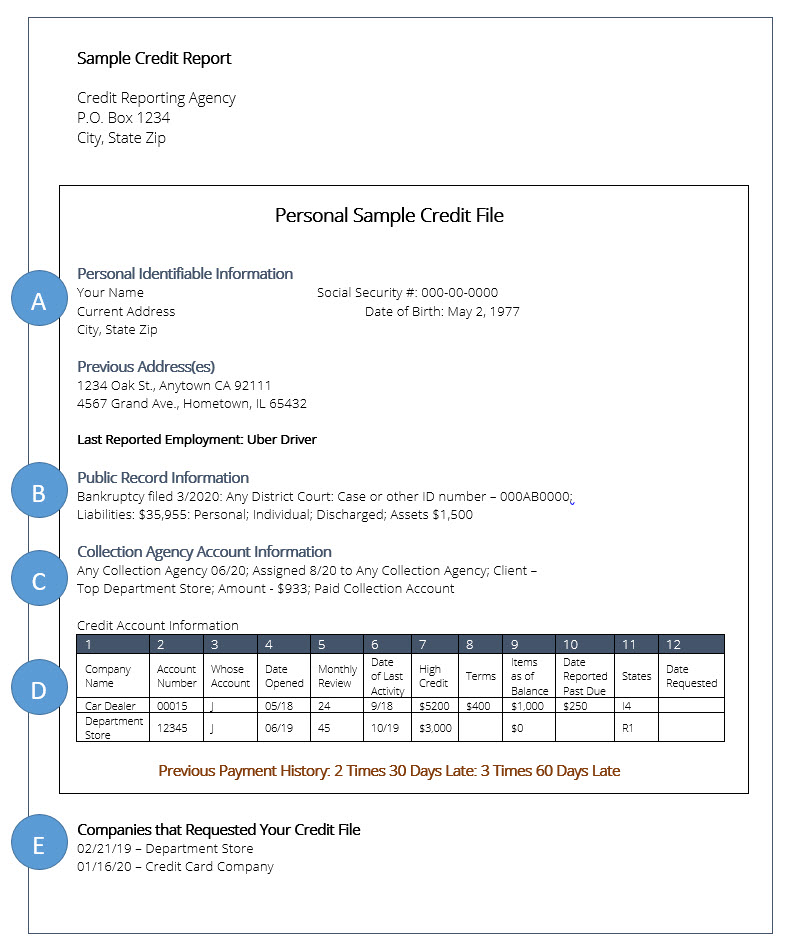

Here’s how to read the sample credit report:

- Section A shows information about you — your name, current and previous address, Social Security number, date of birth, and other information to identify you.

- Section B is called Public Record Information. In this area, you’ll see any information that is listed about you in the records of local, state, or federal courts. In this example you see a bankruptcy.

- Section C shows collection agency account information. If you fail to pay back one of your creditors, they may hire a collection agency to contact you. This is a company that specializes in collecting money to pay off debts.

- Section D shows your credit history. This is a list of all the places where you have credit — or used to have credit. These are called your accounts. The credit history section is divided into twelve columns.

- Section E, the last section of the credit report, is called Inquiries. This is a list of the companies that have requested a copy of your credit report for their review.

details of your history

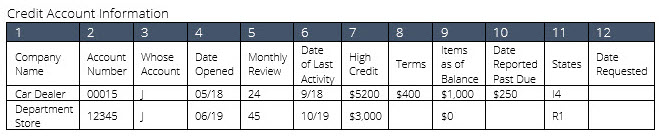

The credit history section of the credit report is divided into twelve columns:

- Column 1 shows the names of your lenders. In this example you see a car dealership, a credit card company, and a department store.

- Column 2 shows your account numbers.

- Column 3 shows who is responsible for payment. On most credit reports, you’ll see an “I” — meaning that an individual is responsible. Or you’ll see a “J” for joint — meaning that you and another person are responsible for paying.

- Column 4 shows the month and year the account was opened.

- Column 5 shows the number of months the payment history for this account has been reported.

- Column 6 – You’ll see the date that the last payment, change, or other activity was made in this account.

- Column 7 – You’ll see the highest amount that has been charged to this account, or the credit limit, if there is one.

- Column 8 shows the amount of your monthly payments — if this is an installment loan.

- Column 9 shows the amount you still owe as of the date of this report.

- Column 10 shows any amount that is past due. This means money that you’re late in paying to your lender.

- Column 11 is called Status. It contains a letter and a number. The letter describes what kind of account it is. “I” means installment. This means you make a loan payment every month for a certain period of months. “R” means revolving. Credit cards are called revolving credit because as you pay the money back, your credit becomes available for you to use again and again. “O” means open. This means that the lender decides to give you credit and then bills you for what you borrow. What do the numbers mean? “1” means the account is paid as agreed; “2” means the account is 30 or more days past due; “3” means the account is 60 or more days past due. In this example, the car loan is I4. This means it’s an installment loan that’s 90 or more days past the payment due date. Not good!

- Column 12 shows the date on which the information for this account was last updated.

correcting reporting errors

When you receive your report, check for mistakes in your name, social security number, former addresses, accounts you didn’t open, and errors in your history. If you think that information on your report is incorrect or out of date, contact the credit reporting agency and ask for an explanation. Requesting changes to your credit report is easy in some cases, and more difficult in others.

As you check your reports for errors, keep in mind:

- Credit bureaus process millions of pieces of information every year and sometimes errors occur as a result. You may find information on your report about someone with a similar name or address to yours. If they have poor credit, it may hurt your ability to get a loan or credit.

- Late payments can hurt your credit score. If your report shows a late credit card payment and you know you pay your bills on time, contact the credit bureau to dispute it.

- The Public Records section shows tax liens, bankruptcies, and default judgments against you. These kinds of items are extremely damaging to your credit score, so be sure to challenge errors right away.

What kind of errors should you check for?

Confirm everything in your report! Start by checking whether your name and social security number are correct; then review every item on every account. Be thorough because any errors could affect your rating. Pay special attention to these items:

If the report shows an address where you never resided, contact the credit bureau. This could mean that someone at that address fraudulently claimed to be you.

If there are credit accounts listed that you didn’t open, contact the credit bureau immediately. This could be a sign that you’ve been the victim of identity theft.

Check each credit account to see if it accurately shows your history. For example, if a credit card account is listed as having been 60 days past due, but you’ve always paid your bills on time, contact that creditor and request that they fix the error.

Learn more from the FTC

For further information about disputing errors and improving your credit report, visit the Federal Trade Commission (FTC) Web site at www.ftc.gov.