Credit cards can be a valuable financial tool. They provide a convenient way to pay for things, have built in protections for your purchases, and can help you to build a good credit rating. Using credit cards can also cost you money in finance charges and fees. Learning how to manage your credit card will help you in the long run.

ONLINE CARD MANAGEMENT

Credit card companies offer many different tools to help you manage your card. After getting your credit card, consider setting up an online account. Also, if available, download the mobile app. Once you are setup online or with the app, here are some of the things you can do to manage your card:

- Check Your Balance

- Check Your Purchase History

- Make a Payment

- Find Your Billing Statement

- Setup a Payment Schedule

- Get Alerts on Your Phone or via Email

- Get Fraud Alerts

credit CARD Statement

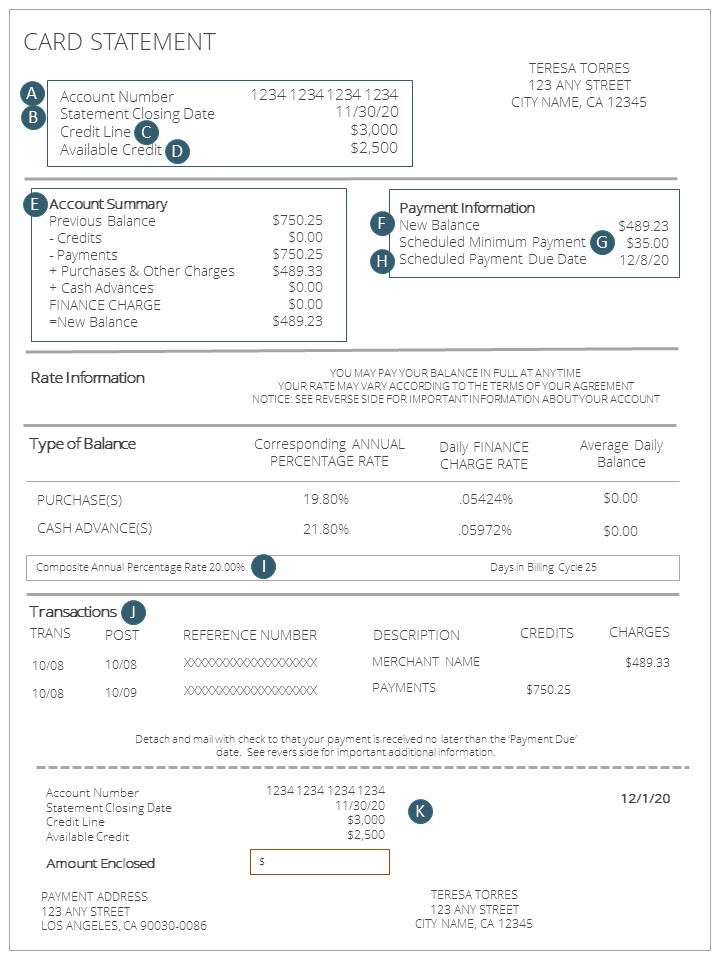

A – Account Number – Your credit card account number — Remember to keep it a secret, or others can use your account.

B – Statement Closing Date – The closing date of the statement is the date the credit card company created this statement.

C – Credit Line – The amount of your credit line is your spending limit.

D – Available Credit – Available credit is the amount of your credit that you haven’t borrowed yet, so it’s still available to you.

E – Account Summary – The account summary section summarizes your transactions.

F – New Balance – Payment information shows the total amount you now owe, which is also called your new balance.

G – Scheduled Minimum Payment – Each month you must pay at least this portion of what you owe. If you wish, you may pay more than the minimum, up to the total amount, if you can. If you want to have good credit, and reduce the amount of interest you’ll pay, it’s a good idea to pay more than the minimum payment each month.

H – Scheduled Payment Due Date – Unless your credit card company receives your payment by this date, they will begin charging you interest on the amount you owe. Most companies will also charge you a late fee. They may also increase your interest rate.

I – Composite Annual Percentage Rate – Rate information shows you how the interest and fees are being calculated.

J – Transactions – In the transactions section, you’ll see a list of each charge and payment you made in date order.

K – Payment Coupon – The payment coupon helps the credit card issuer process your payment and apply the payment to the correct account. Be sure to include the payment coupon in the envelope with the check or money order.

finance charges

A finance charge is the total cost of borrowing money, which includes interest and fees. The easiest way to avoid paying finance charges is to pay your full statement balance in full before the due date each month. It may be easier to payments each week or biweekly. Here are some other tips to avoid finance charges:

- If you cannot pay your balance in full, pay as much as possible every week or month.

- Pay at least the minimum amount due on your statement.

- Pay on time, every time and do not exceed your credit limit.

Note – Some credit card issuers will charge a default rate (a higher rate of interest) if a cardholder misses two minimum monthly payments.

Understanding how creditors calculate interest can also help you to manage your costs. Here is information that can help:

How is your interest calculated? After you know the APR and Periodic Rate, look at how the creditor calculates the interest you owe. This can make a big difference in how much interest you’ll pay.

what does it really cost?

This example shows how to save money on interest. Let’s say you purchased a new laptop for $500 with a credit card. Review this chart to see what you’ll really pay when using a credit card with a lower interest rate, and one with a higher interest rate.

Compare a $500 purchase on 2 cards with different interest rates

| Credit Card Options | Interest Rate (APR) | Pay Within (Months) | Total Paid | Total Paid |

|---|---|---|---|---|

| Credit Card A | 8% | 12 | $40 | $540 |

| Credit Card B | 18% | 12 | $90 | $590 |

Comparing the two examples above, you see that the card with the lower interest rate would cost you $50 less and you can see how the difference in the interest rate affects the total amount of interest each customer paid.

To avoid paying interest on new purchases you have to pay your entire new balance by the due date on your statement each billing period. Be sure to consider that there is no grace period on balance transfers and cash advances – you cannot avoid paying interest on balance transfers and cash advances.

If you decide to repay over time, you’ll be charged interest on the unpaid balance each month (the amount you still owe). When you pay interest on top of your charges, you end up spending more than you would have if you only used cash.

CANCELLING YOUR CARD

If you want to cancel a credit card, contact the issuer of the card directly and request your account to be closed. Also, ask for a confirmation letter. Simply not using the card will not cause it to cancel. You can also check your credit report to confirm that your account has been closed.

Shred, or use scissors to cut into small pieces, any offers you don’t want before you toss them into the garbage. This will help prevent someone from stealing it and trying to obtain credit in your name, which is a crime called identity theft.