Article summary: A checking account can help you manage day-to-day financial transactions efficiently and securely in today’s digital world. Here’s why checking accounts matter — and what to know about opening an account.

A checking account is a type of bank account you can use for everyday spending. You can use your account to track expenses, connect it to your favorite payment apps, and even use it to receive your pay automatically through direct deposit.

Banks provide benefits like fraud and theft protection for account holders, which other payment options may not offer. Here’s what to know about checking accounts.

Why open a checking Account?

Here are four main reasons to open a checking account:

- Safety: Lost or stolen cash can be hard to recover. A checking account, however, will likely offer services like fraud detection and prevention to help keep your money safe. Plus, the Federal Deposit Insurance Corporation (FDIC) insures checking and other bank accounts for up to $250,000 per account holder if the account is at an FDIC-insured bank. The FDIC also monitors banks to make sure they are acting in the best interest of account holders. (If your checking account is with a credit union, it is insured by the National Credit Union Administration (NCAU).) [1]

- Convenience: A checking account typically comes with a debit card, which you can use to withdraw cash, deposit money, and make purchases. Your checking account can also be connected to payment apps like Cash App, PayPal, or Venmo, which let you easily send and receive money without using cash or checks. And with mobile banking, you may be able to deposit checks using your phone’s camera.

- Money management: Your bank keeps a record of every transaction, withdrawal, and deposit. You can use your mobile banking app or log on from a computer to quickly view transactions and account balances.

- A building block for future growth: Opening a checking account can help you create a relationship with a bank. Good relationships could lead to other helpful financial products, like lines of credit, loans, and investment accounts.

how to open a checking account

Before you visit the bank, call the branch or check their website to find out what they need from you to get started. It might include a minimum deposit to open the account.

What identification should I bring to the bank?

The law requires banks to verify your identity to prevent fraud. They usually need three forms of identification:

- Your Social Security number or Taxpayer Identification Number

- A government-issued photo ID

- Proof of address (rental agreement or lease, utility bill, or cell phone bill)

Banks may accept the following forms of government-issued ID:

- Driver’s license or state ID

- Passport

- U.S. military ID (Common Access Card or Uniformed Services ID)

- Permanent resident card (also called a green card or alien registration card)

- Matricula Consular card

If you have questions, if you don’t have any of these forms of ID, or if you are not a U.S. citizen, call or visit a bank to find out their specific requirements.

What if I’m opening an account for a minor?

A parent or guardian must accompany people under age 18 (19 in Nebraska). Banks may also want two forms of ID for the account holder, such as two of the following:

- Birth certificate

- Immunization record

- Student ID

- Social Security card

What does a checking account cost?

It varies — the only way to know for sure about any fees is to get details from the bank. For example, some banks don’t charge anything for you to have an account, but only if you keep a minimum amount of money in the account. Others charge a monthly service fee, which can be as low as $5 or more than $20 depending on their features. Some banks may also charge a fee when you use an ATM that is outside of their network. And almost all banks charge a fee if you overdraw — meaning you spend more than you have in the account.

If you’re looking for a low- or no-fee checking account, the online platform Bank On provides a list of banks offering accounts that meet its standards for low cost with modern features. You can find options by state or bank name.

WHAT TO KNOW ABOUT CONNECTING YOUR CHECKING ACCOUNT TO PAYMENT APPS

Connecting payment apps to your checking account can make it easy to send, receive, and track payments. Popular apps like PayPal, Cash App, and Venmo offer instant payment transfers. And saving your debit card info to a digital wallet like Apple Pay or Google Pay lets you use your phone for purchases if your physical card isn’t nearby.

Some payment apps may charge fees for certain transactions and may not offer the same level of fraud protection. Learn more about the difference between payment and banking apps.

UNDERSTANDING PAPER CHECKS

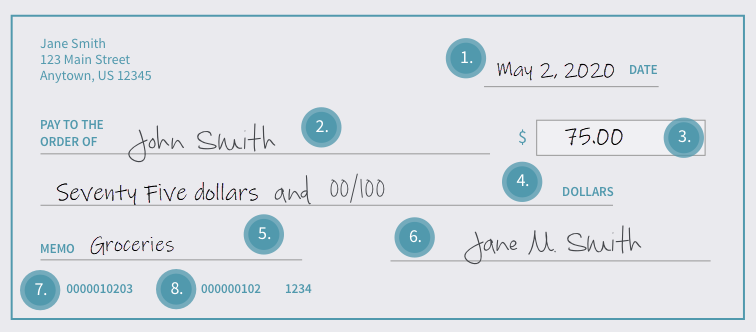

A check tells a bank how much to pay, what account to use, and who receives the money. Here’s what you should know about them:

- The date the check can be cashed on (or after).

- The name of the person/company you’re paying (you can even write your name or “Cash” if making a withdrawal for yourself).

- The numerical amount of the check.

- The amount of the check in words (the formatting for cents should be written as a fraction, like 50/100 for $0.50).

- A description of what the check is for (optional).

- The account holder’s signature.

- The account number of the checking account the money will be drawn from.

- The routing number, which identifies the bank issuing the check.

Check writing tips:

- Write clearly and in ink.

- Draw a horizontal line through the blank space after the written amount to keep others from changing it.

- Sign the check last to ensure it’s only cashed for the amount you authorized.

- Record every check in your check register to keep track of your expenses.

How to endorse a check

When you deposit or cash a check, signing in the endorsement box on the back tells the bank you approve the transaction and helps them confirm your identity. Below your signature, write the account number where you want the funds deposited. Write “For deposit only” to prevent others from cashing it.

Avoiding checking account overdrafts

An overdraft is when you spend more than you have in your checking account. To avoid overdrafts, follow these tips. [2, 3]

- Check your account balance and transactions regularly. Use a budgeting app or spreadsheet to track your spending.

- Time bill payments when you expect to have money in your checking account. Some lenders may let you change payment due dates to better align with your pay schedule.

- Set up notifications in your bank app to alert you when your balance dips below a certain amount.

SOURCES

- Federal Deposit Insurance Corporation (FDIC). About.

- Consumer Financial Protection Bureau. (January 31, 2024). What is an overdraft?

- Consumer Financial Protection Bureau. (August 30, 2024). How can I avoid debit card overdrafts?

Want to learn more about modern banking and ways to manage your money? Discover more here: