common types of savings accounts

Savings accounts are one way to build your financial foundation. Many financial experts suggest savings accounts will help give you peace of mind and help you prepare for your future. As a money management tool, your savings account can help you save for a goal, prepare for emergencies, earn interest, and generally build healthy financial habits. Research has found that having a savings mindset and saving for long-term goals is associated with greater financial success.

When you deposit money into a savings account, your money is always available to you but you may have an opportunity to earn greater interest depending on where you save it and how long you save it. Essentially, you earn interest on your savings account because you are allowing your financial institution to borrow your deposit and lend it to other customers (or members, if you have a credit union account). Earning interest allows your savings to grow faster. There are several different savings accounts but here are a few common types that pay varying levels of interest:

With this account, you’re allowed to put money in (make a deposit), or take money out (make a withdrawal). To keep your account open – or avoid a fee – the bank may require you to keep a certain amount of money in the account, called a minimum balance, at all times. They will also limit the number of times you can withdraw money each month. You also earn interest.

Like a regular savings account, a money market account also pays interest. It may require a higher minimum balance, but it offers two other advantages. First, you receive checks you can use to make withdrawals. There are restrictions on the number of withdrawals made by check, but the ability to write a check is very convenient. The second advantage is that money market accounts generally have higher interest rates than regular savings accounts.

Certificates of deposit, or CDs, require you to keep your money in an account for a fixed period of time, from perhaps a few months to five or more years. This period of time is called the term. The interest you earn on CDs is generally higher than on a regular savings or money market account. The bank rewards you with higher interest because you are allowing them to use your money for a longer term. If you withdraw your money before the end of the term, you may have to pay a penalty. This penalty is often a reduction or forfeiture of the interest earned

how to open a savings account

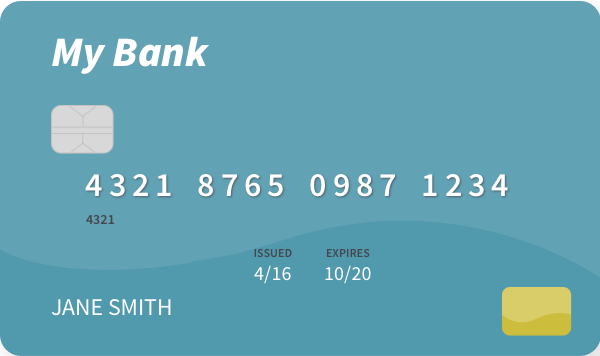

Before you go to the bank, see what you need to bring with you. Keep in mind that different banks have different requirements for opening accounts, including a minimum age requirement for having accounts of your own. When you open a checking account, the bank will need to verify your identity. You may need to bring one or more pieces of identification along with money for your initial deposit. Be prepared by asking your bank in advance if there will be a minimum opening deposit required.

Ask your bank which forms of ID they accept, for example:

- Driver’s license or state ID

- Passport

- U.S. military ID

- Alien Registration card

- If you’re in the military, U.S. military ID (CAC Card)

- If you’re a military dependent, U.S. military dependent ID

A parent or guardian must accompany a person under 18 (19 in Nebraska) and usually must bring two forms of current identification for the person under 18. Ask your bank which forms of ID they accept for persons under 18, for example:

- Birth certificate

- Immunization record

- Student ID

- Social Security card

Ask if there are special programs that you are eligible for. For example, many financial institutions may offer a special military or student account.