Article summary: A digital wallet lets you pay quickly and securely using your phone or other connected device without reaching for a card or cash. Here’s why digital wallets matter — and how to use them safely.

More and more people are using digital wallets — connected tools like Apple Pay or Google Pay that let you store payment information securely — when making purchases. Why? Because you can quickly make payments with your phone or computer if you have a digital wallet.

Digital wallets are very easy to use. For example, you can make purchases by holding a smartphone up to a payment terminal at a register instead of reaching for a card. That might be why Juniper Research predicts that more than half the world’s population will use digital wallets by 2026.

But how do digital wallets work, and what do you need to know to use them safely? Here’s what to keep in mind.

HOW DOES A DIGITAL WALLET WORK?

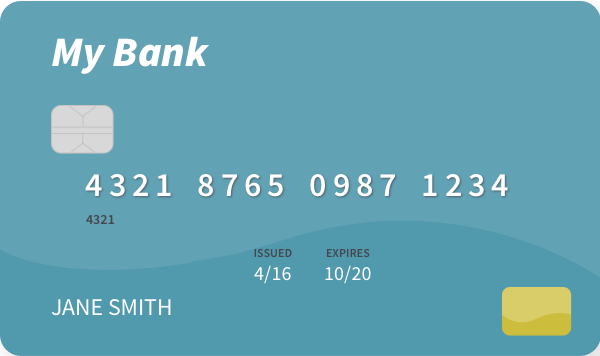

A digital wallet is an app or tool you can access from a mobile device or a computer. Digital wallets let you log in and save forms of payment — debit cards, credit cards, and bank account information. It’s like a real wallet, but in electronic form. Some digital wallets may even let you store coupons and rewards cards in them.

When you make a purchase, digital wallets use your mobile device’s wireless technology — Bluetooth, Wi-Fi, and NFC technology — to instantly and securely send your payment information. These transactions are typically completed by scanning a QR code with your phone’s camera or by touching two smart devices together.

You can also use a digital wallet like Google Pay or Apple Pay when shopping online. In this case, the online store will ask you to confirm which stored payment info you would like to use to complete the transaction. To prove you are authorized to use the payment method, your device may ask for a thumbprint, facial recognition, or the three-digit security code found on the back of your credit or debit card.

ARE DIGITAL WALLETS SECURE?

Digital wallets use security features like encryption to store and send your payment information safely. To make sure you have the latest security features, you should choose a well-known digital wallet provider and follow best practices to keep your device and your account safe.

WHAT YOU CAN (AND CAN’T) DO WITH A DIGITAL WALLET

While digital wallets are versatile, they do have some limitations. Here’s a quick look at what you can — and can’t — do with a digital wallet.

You can:

- Often hold your smartphone against another smart device to make contactless payments in person.

- Make secure online purchases without entering your payment information repeatedly.

- Send money to friends and family with only a few taps.

- Store and organize loyalty cards, coupons, and event tickets for easy access.

You can’t:

- Withdraw physical cash using stored payment methods.

- Use the wallet where digital payments aren’t accepted.

THINGS TO WATCH OUT FOR WHEN USING A DIGITAL WALLET

While digital wallets can offer secure, convenient payment benefits, they aren’t completely free from risk. Here are some issues to watch for, and steps to take if you spot a problem.

Unauthorized transactions: If you notice suspicious activity in your digital wallet, like unexpected charges or transfers, update your passwords or login methods to secure your account. You will also likely need to contact your bank or card provider to let them know of any fraudulent charges, just as you would with suspected fraud with other forms of payment.

Phishing attempts: You might receive unsolicited emails or text messages that try to trick you into sharing your digital wallet login information. Keep in mind, digital wallet providers will never ask you to provide sensitive information in this way.

Security issues: Your digital wallet provider will likely send emails regarding privacy and security, especially if there has been a problem. Stay informed about any security breaches or weaknesses that could affect your digital wallet — and keep your devices and apps up to date so you have the latest protections.

CONSIDERATIONS FOR PEACE OF MIND

These best practices will help you stay as safe as possible with a digital wallet:

- Choose a well-known digital wallet provider with a proven track record of security.

- Turn on extra security like multifactor authentication, to keep others from accessing your account. Multifactor authentication requires the person logging in to prove they’re the account holder.

- Monitor your transactions for unusual activity that suggests someone may have accessed your account without your permission.

- Keep software up to date on your device and your digital wallet app to make sure your financial information is protected by the most recent security features.

Want to learn about modern banking and ways to manage your money? Discover more here: