Article summary: Putting your money in financial institutions can offer security, convenience, and financial peace of mind. Here’s what you need to know about the basics of banking.

What do you think of when you hear the word “bank”? A place to store your money? Somewhere you can go to cash a paycheck? A business where you can borrow money for a big purchase? A bank can be all of these things, but the truth is that financial institutions like banks, credit unions, and even online banks offer a lot more, too. Here’s what you need to know about financial institutions and the basics of banking.

WHAT FINANCIAL INSTITUTIONs do

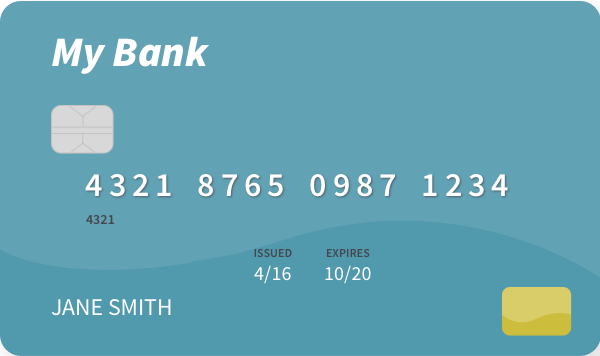

Financial institutions — banks and credit unions — provide a holding place for money and tools to manage money. Customers can deposit money in accounts like checking accounts and savings accounts. They can spend their money and make payments from their accounts using tools like debit cards, online transfers, and checks. Financial institutions may pay customers a little bit of money, called interest, for keeping funds there.

In turn, financial institutions use those deposits as pools of money to lend to other customers. (But customers’ deposits are protected and still always available to them.) Banks and credit unions may also offer other financial products and services, like credit cards and investment accounts. They charge fees and charge interest on loans as compensation for the services they provide.

TYPES OF FINANCIAL INSTITUTIONS

Here are the main types of financial institutions:

- Banks: The most common type of financial institution, banks are businesses that provide the money management services described above. A bank may be national or regional with a large network of branch locations, or it may be a small community bank with one or a few locations. Most banks also offer online and mobile services.

- Credit unions: These are not-for-profit financial institutions that offer many of the same services as banks. A credit union serves a particular group of people, such as anyone who lives in a geographic area or people who work in a certain industry. Customers are called members.

- Online-only banks: These banks are exclusively online, with no physical locations. They offer many of the same services as traditional banks. Customers access their accounts through a website or mobile app. The bank might provide an ATM card to access cash, possibly for a fee. With many online-only banks, customers can get help from a service representative by phone, but in-person service is not available.

All three types of financial institutions can be members of the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), which insure customers’ deposits. So if something happens to the insured institution, each depositor will get their money back, up to $250,000 per account ownership category. Plus, financial institutions must follow laws and regulations that keep customers’ money safe.

WHY USE A FINANCIAL INSTITUTION?

The term “bank account” is often used to refer generally to a deposit account at a bank or credit union (to keep things simple, that’s how we use it in this article). A bank account is a safe, convenient way to handle everyday transactions. Here are a few of the benefits:

Safety and security

Depositing your money in a bank is safer than carrying it around with you. Cash can easily get lost, stolen, or destroyed — and once it’s gone, you’re out of luck. If your money is in a bank, you know it’s protected but still easy to access.

Convenience

Financial institutions offer many ways to manage and use your money, including:

- Debit and ATM cards

- Checks

- Online banking

- Mobile apps

- Bank branches with financial professionals who can help

You can use your debit card to conveniently get cash at many retail locations, like grocery stores, and you can use it or a digital wallet to make purchases or pay bills. New technology has made it easy to quickly transfer money or manage your accounts using your bank’s app — putting around-the-clock access to your money at your fingertips.

Cost savings

Many people who don’t have bank accounts use alternatives like check-cashing services or payday lenders. However, these businesses charge higher fees, which can be costly.

Check-cashing stores generally charge up to 10% of your check’s value in fees. For example, if you cash a $500 check and the fee is 5%, you lose $25. If that’s your weekly paycheck, you would pay $1,300 a year in fees. Payday loans commonly cost $15 per $100 borrowed, with fees adding up if you need to extend the loan. A payday loan can wind up costing you significantly more than you originally borrowed.

Having a bank account where you can deposit money and build savings will cost you far less in the long run.

Access to advice and guidance

By working with a bank, you’ll be able to talk to and work with a variety of financial professionals. Their knowledgeable advice can be a valuable resource to help you and your family build a better financial future.