introduction to military retirement

Servicemembers who remain on active duty or serve in the Reserves or Guard for a sufficient period of time (usually a minimum of 20 years) may retire and receive military retirement pay. Prior to the 2017 National Defense Authorization Act that provided a new way to save for retirement, servicemembers were enrolled in the legacy retirement system (Higher 3 or High 36). This system provided a pension, also known as defined benefit plan, to servicemembers.

A defined benefit plan is a type of retirement plan in which an employer contributes to a common asset pool of funds set aside for employees’ future benefit. These funds are then invested on the employees’ behalf. The employees receive the funds upon retirement. A defined benefit plan provides a specific income for retired employees, either as a lump sum or as a pension (an annual lifetime payment). The pension amount usually depends on the employee’s age at retirement, final salary, and the number of years on the job.

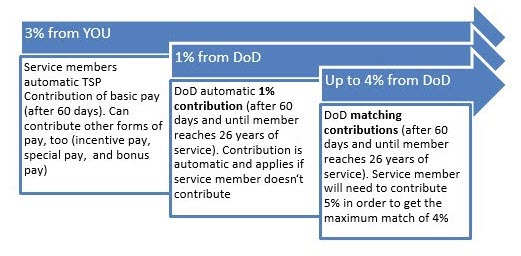

In 2018, servicemembers were eligible to participate in a modernized retirement system, the Blended Retirement System (BRS). This new military retirement system is expected to provide retirement benefits for nearly 85% of military service members. The Blended Retirement System (BRS) combines the 20-year military retirement (defined annuity), with a defined contribution plan, known as the Thrift Savings Plan (TSP), which includes an automatic 1% Department of Defense (DoD) contribution after 60 days of service and up to 4% additional matching contributions after the completion of two years of service (see Figure 1). The defined annuity, or monthly retirement pay, can be paid as a fixed monthly payment or can be split as a partial lump sum payment. The automatic 1% DoD contribution and matching contributions continue through the end of the pay period of which the service member reaches 26 years of service. These contributions can help build your retirement savings.

How Does Military Retirement Work4?

While there are several TSP investment options, the government and matching contributions will be contributed to Lifecycle fund nearest the service member’s 62nd birthday as a default. This investment concept is based on age-based or target-date funds based on the date you are likely to retire. The target-date fund uses an asset allocation formula that assumes you will retire in a certain year and adjusts the way funds are invested to reduce risk as you near retirement.

How do I enroll?

All service members who enter the military on or after January 1, 2018 will automatically be enrolled in the BRS.

How Much Can I Save?

In the BRS, service members are automatically enrolled at a 3% individual contribution; however, the amount can be adjusted as there is no minimum mandatory contribution amount. In order to maximize the government and DoD contributions, service members should contribute at least 5% monthly (see Figure 2). TSP contributions limits are based on IRS guidelines. Two annual limits apply to contributions: a limit on employee elective deferrals; and an overall limit on contributions to a participant’s plan account. Currently the limit on employee contributions (or elective deferrals) is $19,500; however, the guidelines can change annually2. While there is an annual aggregate limit, there is a provision for additional elective deferrals for individuals age 50 and over and for service members that serve in a combat zone can contribute up to $57,000 to their traditional account. Both exceptions and special treatments offer increased opportunity for savings.

For individuals age 50 and over, can make additional deferrals also called catch-up contributions. You don’t need to be “behind” in your plan contributions in order to be eligible to make these additional elective deferrals. If permitted by the plan, participants who are age 50 or over at the end of the calendar year can make these additional contributions, which are currently limited at $6,500. Both these annual and catch-up contribution may be increased in future years for cost-of-living adjustments. For more information, visit: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits.

Service members that serve in a combat zone can make additional contributions to their retirement account. These combat zone contributions can include special, incentive, or bonus pay earned in a combat zone. Contributing a bonus earned in a combat zone may be a great way for a member to increase retirement savings.

When Am I Vested?

Individual contributions are immediately vested upon payment to TSP as well as subsequent earnings on those contributions when earnings accrue. The government’s automatic contribution, of 1%, is fully vested on the first day of the 25th month of service. Essentially, you forfeit those contributions and any earnings on those contributions if you do not achieve two years of service. On the other hand, the government matching contribution is fully vested upon receipt in the member’s TSP account. Your accrued earnings, on the matched contributions, are immediately vested.

Why Should I Save Now?

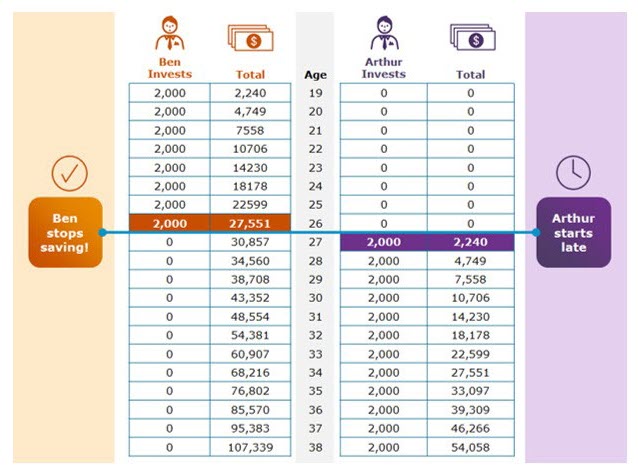

It’s important to start saving for retirement now. The earlier you begin saving, the longer your money can work and grow. When you put money into a retirement account, you benefit from compound interest or interest on the money you contribute. In this way, your money grows faster than it would from your contributions alone. The power of compound interest is magnified the earlier you start. Your automatic individual contribution is 3% but you can always save more. Try to save at 5% every month to take advantage of the DoD match or you will be leaving behind “free money”. Ideally you want to be saving 10% or more of your income annually to your retirement plan in order to have enough income during retirement. As noted in the figure below, by starting early Ben has the advantage of compound interest – even when he stops saving.

While it may be tough to make saving for retirement a priority, saving regularly, even if the amounts are small, can yield big balances down the road. Try to save as much as you comfortably can. Additionally, matching contributions can provide a valuable boost to your retirement savings. As such, it is recommended that you strive to save at least what the matching contribution would be (see Figure 2). You may be able to make some investments that have higher risk and higher potential reward compared to a person closer to retirement age who needs to be more conservative. Some people never get started with retirement saving. Year after year, they spend their time and resources on their current needs. Then one day they realize that retirement age is approaching fast and they’re totally unprepared. Don’t let it happen to you!

How and When Do I Access My Military Retirement Funds?

In general, there are three potential transition periods when a service member may consider accessing contributions: separation from the Armed Forces, transition from Active Duty to Reserve/National Guard, or retirement from Active Duty.

When you separate from the Armed Forces, there are four TSP account options that may apply: keep funds in account, rollover to an employer-sponsored retirement plan, rollover to an individual retirement plan, or cash out. There are benefits and consequences for each of these decisions, including tax implications. One important benefit of the TSP is that you can roll – or deposit – eligible funds back into your pre-existing TSP account. For example, if you leave federal service and have a retirement account, if you return to federal service you can roll any new retirement funds into your pre-existing TSP. If you think you may return to federal government or armed services, you may want to maintain their TSP account. For more information on your options, contact your Human Resources office.

When transitioning from Active Duty to Reserve/National Guard, you want to understand the regulations and procedures for crediting years of service and retirement points. Additionally, you may be eligible Continuation Pay as an incentive to stay with the military. Continuation Pay encourages service members to continue serving in the Uniformed Services for an additional four years. Continuation Pay is a direct cash payout, ranging from 2.5 months to 13 months of basic pay for an active-duty member and ranging from ½ month to 6 months for reserve component members. You can learn more about Continuation Pay and your eligibility as you near service completion. There are several things you may want to consider if you want to take advantage of this opportunity.

First, you will need to understand the associated calculations with this financial benefit. Payable in a single lump sum or a series of up to four annual payments over four consecutive years, Continuation Pay is subject to applicable taxes. It is important to consider the tax implications of one-time versus installment options. Continuation Pay is a prime opportunity to enhance your retirement savings by making additional contributions to your TSP account. These pre-tax contributions may also help offset your taxable income and reduce your tax liability.

Organize your paperwork

Retirement Planning

In order to be best prepared for retirement, start today! Retirement planning can help you have enough money to enjoy a comfortable lifestyle without having to work. Because all investments carry risk, it is important to learn more about the retirement planning process. Educating yourself is the best first step in making an informed decision5.

Take action now to plan your future so that you can achieve your retirement goals

Start saving now and give your money time to grow.

Review your plan and benefits periodically

Your situation may change over time.

Special Credit Considerations

Military personnel have a lot at stake when it comes to bad credit. If your credit is bad, or you declare bankruptcy, you could lose your security clearance and jeopardize your ranking in the Armed Services.

Borrowing too much money and being unable to pay it back is a huge problem in the United States and affects military personnel and their families. Usually, it’s one of the top reasons why service members lose their security clearance.

Don’t lose your security clearance!

In addition to typical issues that arise when/if you have credit blemishes, such as having the inability to get a credit card or being charged higher rates, you might jeopardize your security clearance. Your credit history may also be considered when being considered for a military promotion and as a factor when you apply for a job as you transition out of the military.

The material provided above is for information only and is not intended to provide specific investment advice to any individual for any particular purpose. For advice related to your personal situation, you should consult an investment and tax professional. The financial examples provided above are not based on the actual returns of a particular investment or portfolio of investments and are for illustration purposes only. Your actual returns will depend on your specific investments and their performance during the period of time you hold them.1 DoD, National Defense Authorization Act

2 Internal Revenue Service

3 Top 10 Ways to Prepare for Retirement Source: U.S. Department of Labor

4The Pros And Cons Of Target-Date Funds.