Article summary: Understanding bank fees can help you determine the true cost of your bank account — and help you avoid unexpected charges.

Bank accounts like checking and savings accounts are typically considered a relatively safe, convenient way to manage your money. But you may be wondering what those accounts cost. For example: Is there a bank fee to open an account? Or a monthly fee to keep the account open?

Bank fees help financial institutions offset some of the costs of their day-to-day business. Bank fees are similar to the fees you pay for things like streaming services or a mobile phone plan. When you subscribe to a streaming service, you’re paying for access to your favorite TV shows and movies. With bank fees, you’re paying for access to services like checking accounts, debit cards, and savings accounts.

The average U.S. consumer pays $311 in banking and payment service fees annually, according to a recent survey. And while these fees help banks cover the cost of doing business, there are ways to reduce the amount that you pay. There also are many options for low- or no-cost bank accounts; for help finding one, search the list of banks certified by the nonprofit Bank On initiative.

Here, we’ll explain seven of the most common bank fees and offer tips to help you manage these costs.

1. ACCOUNT MAINTENANCE FEE

What it is: This is a basic fee charged for having an account — usually a checking or a savings account — at a financial institution. Sometimes this is a one-time fee, but usually it’s charged monthly. On average, maintenance fees are about $5 to $15 per month, but not every bank charges this fee or charges it on every account.

Why it’s charged: Financial institutions use these fees to pay for operating costs (like maintaining bank branches) and to increase profit. The fees also help pay for certain account features like ATM reimbursement or rewards on daily transactions.

Ways to reduce your fees:

- Shop around to find a bank account with no or low monthly fees — for example, online banks tend to have lower fees in part because they don’t have bank branches to maintain.

- Some banks will waive maintenance fees if you meet other conditions, like keeping a minimum balance or receiving a certain amount in direct deposits, or will offer low- or no-fee accounts for students or military.

- Check your account agreement for other ways to avoid bank fees, like linking your checking and savings accounts or enrolling in direct deposit.

2. MINIMUM BALANCE FEE

What it is: Your bank may require you to keep a certain amount of money in your account at all times. The average minimum balance for a non-interest checking account is $500, according to a Bankrate survey. If your account dips below the minimum balance, you may have to pay a fee. Some minimum balance requirements use the actual dollar amount in the account, but some banks take the average balance over a set period of time. Using an average could be helpful for those without a steady source of income.

Why it’s charged: Minimum balances can help ensure that banks maintain certain federal ratio requirements and can lend more money.

Ways to reduce your fees:

- Regularly monitor your balance online or by using the bank’s mobile app.

- Set up balance alerts so you’ll be notified if your account balance approaches the minimum required.

- Look for a bank account that doesn’t have a minimum balance requirement, like some online bank accounts or student accounts.

3. ATM FEE

What it is: Most banks have a network of ATMs, and many charge a fee for using an ATM that’s outside of that network, like an ATM owned by a different bank. In some situations, you might be charged two bank fees: an ATM fee from your bank for using another financial institution’s ATM, and a convenience fee from the other ATM provider. These fees are usually only a few dollars.

Why it’s charged: ATM fees usually help cover the bank’s costs to maintain and operate the machines (like electricity, security, cash replenishment, etc.). The out-of-network or convenience fee charged by the other bank also helps it cover those costs, as well as the costs to link accounts not carried at the ATM bank.

Ways to reduce your fees:

- Use your bank’s mobile app to find an ATM while on the go. Most offer a locator showing in-network ATMs or bank branches.

- Try to get cash back at the register when you’re making a purchase with your debit card in a store.

- Check with your bank to see if it offers refunds for out-of-network ATM fees up to a certain amount.

4. NON-SUFFICIENT FUNDS FEE OR OVERDRAFT FEE

What it is: If you try to make a purchase that is more than the balance in your account, your bank could decline or reverse the charge and might also charge a nonsufficient funds fee, or NSF. Or the bank might cover the cost of your purchase but charge you an overdraft fee — up to $35 for each transaction. It can depend on what kind of “overdraft protection” the bank offers and whether you have opted in.

Why it’s charged: This fee helps cover the costs associated with reversing the transaction or covering the transaction until you deposit money into the account.

Ways to reduce your fees:

- Monitor your bank account so you have an idea of your balance.

- Set up low balance alerts so you’ll get a notification when your account dips below a certain balance.

- Another type of “overdraft protection” your bank might offer allows you to link your savings account to your checking account so that if you overspend, the bank can automatically transfer money from your savings account to cover the transaction. There’s typically still a bank fee for this service, but it’s usually cheaper than an insufficient funds fee.

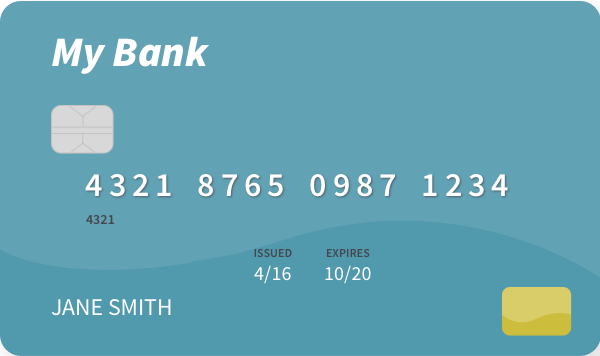

5. CHECK OR CARD ORDERING FEE

What it is: When you open a checking account, your bank may give you a debit card and some checks for free. When you run out of checks, you’ll have to purchase more for a fee, about $25 on average depending on the quantity and style you choose. If you need to replace your debit card, you usually can do that for free, but if you need to rush the replacement, you could pay a bank fee of $5 to $15.

Why it’s charged: You’re paying for the goods and service. The bank fee to rush the replacement of your debit card can help your bank pay for expedited shipping.

Ways to reduce your fees:

- Look for a checking account that offers free checks for maintaining a certain balance or setting up direct deposit.

- Try to reorder checks before you run out, so you don’t have to pay for faster shipping.

- Consider uploading your debit card to your digital wallet to reduce the risk of it being physically lost or stolen. If it is, ask your bank if they will send you a replacement for free — many will, if you ask.

6. PAPER STATEMENT FEE

What it is: When you open a bank account, your bank will send you regular statements listing your most recent transactions and how they affected your account balance. This statement is usually sent monthly.

Why it’s charged: Banks usually charge a small fee — about $5 — each month to send you a paper statement in the mail. The fee covers the costs associated with mailing you a statement, like postage, paper, and envelopes.

Ways to reduce your fees:

- The easiest way to avoid this bank fee is to simply enroll in paperless statements so you’ll receive the info each month via email.

7. EXCESSIVE TRANSACTION FEE

What it is: Some banks limit the number of certain types of transactions you can make each month — such as savings account transactions like overdraft transfers, cash withdrawals, or transfers made by computer, mobile device, or phone. If you go over the limit, you could pay a fee, ranging from $3 to $25 per transaction. The Federal Reserve set the limit to six free “convenience transfers and withdrawals” per month, but suspended the rule in 2020. However, some banks still have limits in place.

Why it’s charged: This helps to pay for the cost of doing business. By limiting the number of savings account transactions, banks also have more deposits on hand, which means they can issue more loans and meet federal ratio requirements.

Ways to reduce your fees:

- The limits usually don’t apply to checking account transactions, so consider using that for your everyday spending.

- Withdrawals or transfers made using an ATM or in person at a bank branch usually aren’t included in the transaction limit, so consider using those methods.

THE BOTTOM LINE

Bank fees are the price tag on banks’ products and services. But not every financial institution charges every one of these bank fees — and not every account at each bank has all these fees or the same kinds of fees. Make sure you know the fees associated with an account before you open it. Banks are required by law to disclose any fees when you open an account, so it’s important to read the fine print on your account agreement carefully. Shop around and find a bank account that matches your needs. And, of course, always monitor your accounts and how much you spend so you don’t have to pay any unnecessary fees.

Want to learn more about your bank account? Discover more here: